Global aquaculture production is projected to grow by 20% over the next decade, reaching 118 million tonnes by 2034, according to the latest OECD-FAO Agricultural Outlook. The report confirms that aquaculture will remain the main driver of growth in global fish production, surpassing capture fisheries in both volume and strategic importance.

By 2034, total aquatic animal production is expected to reach 212 million tonnes, with aquaculture accounting for 56% of that total-up from 52% during the 2022-2024 base period.

“Global production of aquatic animals is projected to increase by 10% by 2034… driven by aquaculture production, which is projected to increase by 20% to 118 metric tonnes,” states the report.

Asia will maintain its dominance in the sector, producing 88% of the world’s aquaculture output in 2034. China, while still the leading producer, is expected to stabilise its global share at around 53%, as production in India and Viet Nam continues to grow.

Africa and Latin America are also set to record the highest percentage growth, albeit from a smaller production base. In both regions, the expansion of aquaculture is driven by government support and increasing local demand for protein-rich food sources.

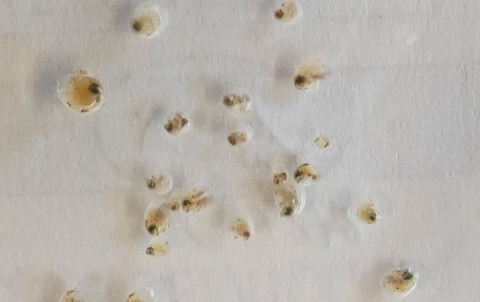

The Outlook identifies three key species categories with the strongest projected growth: shrimp and prawns, 38%; freshwater and diadromous fish (excluding carp and tilapia) 29%; salmonids 26%.

This growth is attributed to rising global demand, technological innovation and investment in intensive systems.

Per capita consumption of aquatic food is projected to rise modestly from 21.1 kg (2022-2024 average) to 21.8 kg by 2034. The increase will be driven mainly by Asia, which will account for 75% of the additional consumption, followed by Africa (15%) and the Americas (11%). Europe is expected to see a slight decline, and per capita consumption in Sub-Saharan Africa will fall due to population growth outpacing production.

Aquatic food trade will grow more slowly than in the past, with around 35% of production expected to be traded internationally by 2034 (31% excluding intra-EU trade). China and Viet Nam will remain leading exporters, while Africa and the Americas will increase to meet growing demand.

The sector faces growing challenges from climate change, extreme weather events, marine heatwaves and water quality degradation. The Outlook warns that these environmental pressures, along with biosecurity threats such as diseases outbreaks and invasive species, could disrupt production and value chains.

In addition, regulatory constraints may slow growth. “Environmental policies and trade restrictions could raise production costs and lead to the relocation of farming operations, particularly in China and the European Union,” the report notes.

The report also includes an updated modelling approach to better reflect aquaculture dynamics, particularly price feedback mechanisms and species-specific production patterns. A special section explains how past models underestimates aquaculture growth, leading to revised projections that are more aligned with observed trends.

The report highlights that the FAO’s Guidelines for Sustainable Aquaculture, approved in 2024, offer a comprehensive policy framework to promote ecologically balanced, economically viable and socially responsible aquaculture.

As the world looks to meet the protein needs of a growing population, the Outlook underscores that aquaculture is not only essential, but also uniquely positioned to support nutrition, livelihoods and economic development-especially in the Global South.