For years, the narrative has been that Europe needs more aquaculture to feed a steadily growing demand for fish. However, the latest European market report published by EUMOFA challenges this assumption and shows that European households are spending more on fishery and aquaculture products, while buying less fish. This is not contradiction, but rather the market’s new equilibrium.

The report also points to a new paradigm, highlighting that Mediterranean producers are playing a crucial role in preventing a deeper market downturn.

In 2024, household expenditure on fish in Europe increased once again, not because consumption rose, but because prices remain high. Between 2020 and 2024, fish prices in the European Union increased by around 25%, a key factor in explaining the decline in consumption. Fresh fish consumption has been falling since 2021, with clear decreases in the main consuming countries.

In 2023, apparent consumption of fishery and aquaculture products in the EU dropped to 22.9 kg per person per year, the lowest level of the past decade. Spain, Italy, Portugal and Greece – countries historically linked to fresh fish consumption – are no exception. Consumers continue to buy fish, but do so more cautiously, adjusting quantities, changing formats and prioritising price and convenience.

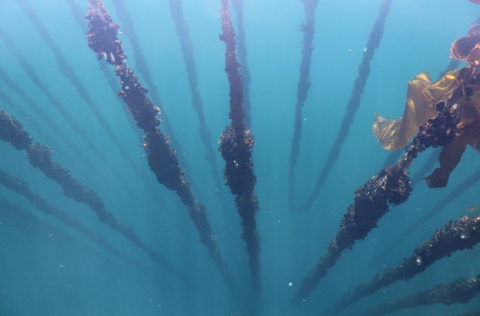

The problem does not lie with aquaculture products, but rather with capture fisheries. According to the report, while consumption of wild-caught fish continues to decline, consumption of aquaculture products remains stable at around 2.9 million tonnes live-weight equivalent, broadly in line with the average of the past ten years.

Put simply, while aquaculture is not growing, it is gaining ground because the alternatives are shrinking. Without gilthead seabream, European seabass, mussels or trout, the decline in consumption would have been even sharper.

Fish prices remain well above pre-crisis levels, resulting in more predictable – though not necessarily comfortable – marings. Feed costs, energy prices, labour and financing continue to shape day-to-day decisions on fish farms.

In this new context, producers must recognise that producing more no longer guarantees selling better. The market is becoming increasingly selective in terms of size, format and certification. Efficiency, moreover, is no longer a competitive advantage but a minimum requirement.

What the report does not fully explain is why consumers are moving away from fresh fish. All indications suggest this is not due to a lack of interest, but rather a combination of high prices, the loss of cooking habits, lack of time, and increasingly aggressive competition from other proteins and more convenient formats.

Under the current model and with these new consumption habits, fish consumption cannot be expected to recover on its own. Some things will need to change for that to happen.